GameFi, the Metaverse, and L2s

With GameFi and Metaverse protocols like The Sandbox taking the world by storm, projects are looking to take the next step to truly take over the gaming industry. But headwinds are blowing their way. With gas fees at all time highs, scaling solutions are becoming increasingly important. Will GameFi survive? Is GameFi and the Metaverse truly the future?

Thinking about buying land in the metaverse? You’re not alone. It seems like everywhere you turn in the crypto space, the burgeoning Metaverse and GameFi protocols are at the forefront of crypto innovation. In fact, today, over 50% of all active crypto wallets regularly connect to decentralized GameFi or Metaverse dApps. But with gas fees at an all time high, GameFi protocols are turning to DeFi scaling solutions to truly spread to the masses.

The Rise of GameFi

From the inception of the computers and the internet, gaming has always been central to the spirit of web innovation. From Pong to Halo to Decentraland, every cycle of modern human innovation has been coupled with changes in the gaming ecosystem.

That’s led to the gaming industry becoming a behemoth – garnering $300 billion in revenue annually from over 40% of the world’s population. With the emergence of blockchain technology, new “GameFi” protocols, named after an amalgamation of “game” and “finance,” represent the new wave of gaming technology.

While players in games like Halo and Pong had previously been restricted to interaction with only others they directly played with, GameFi protocols envision a world where virtual economies on the blockchain can not only monetize in-game assets, but also transfer them between games.

The first example of this monetization was in 2017 with CryptoKitties. CryptoKitties allowed players to create in-game NFTs of their cats. Players could sell them to other players in game – or out of the game on the blockchain. Perhaps a user could take his CryptoKitty and display it in a home built on a virtual plot of land in The Sandbox. Or maybe sell it to buy another GameFi protocol’s NFT. Ultimately, blockchain technology has enabled the play-to-earn model to thrive, enticing players to use GameFi protocols that give them yield and monetized in-game assets.

Today, over 100 million gaming transactions occur on the Ethereum blockchain. Projects like The Sandbox, DeFi Kingdoms, and Decentraland have garnered ecosystems worth billions of dollars, elevating gaming to include staking, exchanges, and investable assets – all built on blockchain technology.

Leaving Gaming’s Old Business Model Behind

For decades, the gaming industry has operated on a simple, yet exploitative model. Users buy into an ecosystem (Xbox, PlayStation, or Steam) and continue to buy games to play. Development studios continue to churn out new games and consoles to entice players to buy games and enter their ecosystem.

And for years, the model has worked! Billions of people across the world have fun. The problem is that the value of items earned in-game go to waste. Once players move on from a particular game, all the time spent accruing valuable items goes to waste.

That’s where GameFi is set to change the game. By allowing gamers to earn cryptocurrencies or NFTs through play, entire economies are born. GameFi projects enrich themselves by accruing users, while also allowing players to enrich themselves while they play.

Sure, there’s nothing inherently wrong with traditional gaming. But GameFi offers a better alternative. It’s clear: GameFi is the future of gaming.

Building Games to Scale to the Masses

With so many players flocking to GameFi projects, a problem has emerged: gas fees. On Ethereum’s Proof of Work (PoW) blockchain, miners work to solve complex mathematical equations to mine “blocks.” In doing so, they allow transactions to occur.

However, there are only so many miners in the world.

This means that transactions often cannot be readily cleared, leading to users having to pay high “gas” fees in order for their transactions to execute on Ethereum. Often, this means having to pay hundreds of dollars for simply exchanging an NFT or gaining in-game token rewards.

Clearly, this isn’t a sustainable ecosystem. With traditional games costing only $50-60 for players to buy, GameFi players simply cannot afford to keep paying exorbitant fees to participate in protocol’s blockchain ecosystems.

That’s led to GameFi projects seeking out innovative scaling solutions to reduce gas fees. With new scaling solutions like side-chains and Layer 2 (L2) technologies from companies like Polygon, Avalanche, and Aurora, GameFi projects finally have an alternative to transacting on the Ethereum blockchain.

In essence, what these technologies do is move transactions away from Ethereum’s central blockchain. By transacting on other blockchains, side-chains and L2s are able to vastly reduce total traffic and create chains that can handle much higher volume.

L2s like Polygon and zkSync are also able to batch transactions together into a single block, spreading costs among multiple users. That translates to tens of thousands of transactions per second – all with fees up to 99% lower than on Ethereum.

With scaling solutions readily available, GameFi projects are taking notice.

How Projects are Building Their Own Worlds

Today, it’s the norm for GameFi projects to be deployed with scaling solutions. One such example is DeFi Kingdoms.

DeFi Kingdoms is a GameFi project that allows users to explore an 8-bit world with their NFT “Hero.” In DeFi Kingdoms, users explore a medieval world while transacting in the protocol’s proprietary $JEWEL token. In the game, users can stake their JEWEL in liquidity pools called “Gardens,” where users can physically see their tokens grow into plants. Users can also deposit the JEWEL they earn in-game at “The Bank,” where the tokens are used for DeFi Kingdom’s Uniswap-style DEX. In exchange, users earn interest on their JEWEL.

A user in DeFi Kingdoms staking their JEWEL in a Garden, receiving claimable rewards.

And the best part is: the value of JEWEL can be used outside of DeFi Kingdoms, possibly swapped for NFTs in other GameFi protocols like The Sandbox of Decentraland – or even assets like USDC or DAI.

But with so many transactions, DeFi Kingdoms had to use robust scaling solutions to ensure frictionless transacting for their users. That’s why they deployed on Harmony One’s chain for lower gas fees. Today, they contribute $280M TVL to Harmony. DeFi Kingdoms also launched on Avalanche, making DeFi Kingdoms a cross-chain, fully compatible ecosystem.

As one gaming industry analyst put it, “It’s like you can take your character from an Xbox game and load them up on a Playstation, and then load them up on a browser.” All that while having tangible, transactable value.

One of the biggest GameFi projects, The Sandbox, is following suit. As one of the biggest and most developed Metaverse projects in the cryptosphere, The Sandbox saw its real estate skyrocket to millions in USD of value. Its land has been acquired by the likes of Snoop Dogg, HSBC, and Gucci, leading it to be named as one of Time’s 100 Most Influential Companies.

In The Sandbox, users can navigate a virtual world and buy land and in-game NFTs – just like they would buy goods in the real world. They can participate in minigames, exchanges, or just explore the world around them.

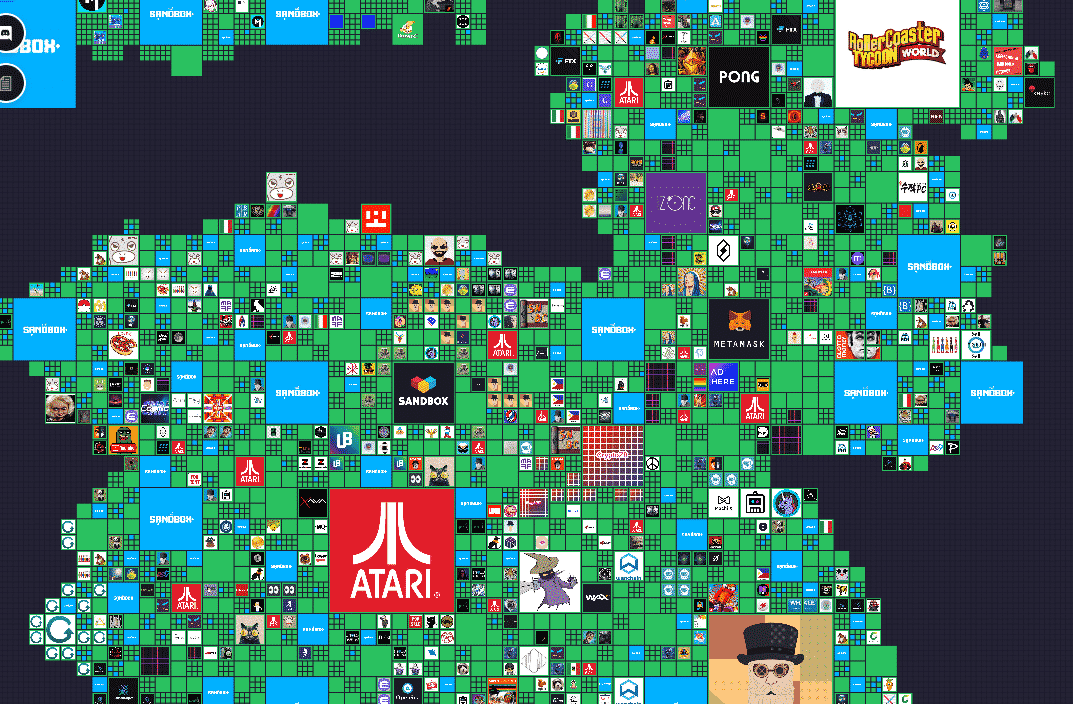

Overview of The Sandbox’s Land

Though, with so much popularity, also came high gas fees. Following user complaints of extremely high gas fees, often more than hundreds of dollars, to transact within their Metaverse, The Sandbox had to start finding solutions.

That’s why The Sandbox has started migrating their NFT and Land contract transactions to Layer 2 scaling solutions. By slowly migrating their smart contracts from the Ethereum blockchain to Polygon’s Layer 2 chain, The Sandbox has reduced gas fees by 99%, making regular transactions and play in The Sandbox extremely user-friendly. Today, you can enter The Sandbox game, acquire an in-game NFT, sell it, stake it, or hodl it – for pennies. You could also buy millions of dollars worth of virtual real estate, and only garner a few dollars worth of transaction costs to do it.

Overall, with Polygon’s Proof of Stake (PoS) consensus mechanism, which requires less transaction energy and cost than Ethereum’s Proof of Work (PoW) mechanism, the Sandbox has achieved lightning quick transaction speeds with pennies on the dollar.

Even more, users have also been able to tap into passive income with Polygon’s L2 integration in The Sandbox. Users can now directly stake their mSAND tokens while getting passive rewards/interest inside The Sandbox’s ecosystem.

By taking existing infrastructure and amplifying it on L2 scaling solutions, GameFi protocols are taking one step further to taking over the gaming (and even real) world.

Looking to the Future

Ultimately, while no GameFi project has replaced the current gaming world, it seems like the first steps towards the eventual migration to digital GameFi worlds have already been taken. With in-game assets now tradeable, interest-bearing, and more overall more valuable to everyday players, GameFi projects have proved themselves to be an upgrade from traditional gaming infrastructures. And with L2 solutions blasting GameFi protocols and making them available to the masses, only time will tell how large they can truly grow.

GameFi is here. Ready to play?

Resources:

https://crypto.news/rise-gamefi-global-gaming-beyond/

https://kyoko-finance.medium.com/gamefi-getting-defi-ed-the-future-is-here-ccfd3bddc885

https://thedefiant.io/defi-kingdoms-axie-infinity-nfts/

https://medium.com/sandbox-game/preparing-for-land-smart-contract-migration-to-layer-2-ddc7485fa0e9

https://medium.com/sandbox-game/introducing-sand-staking-on-polygon-462a671e8a9d

Author is a Decentralized Finance (DeFi) intern at Polygon, highly interested in synthetics, web3 derivatives, and blockchain applicability in the real world. They’re a student at New York University – Stern School of Business, studying finance. Other interests range from baseball to The Office to geopolitics.